How prepared are you to enter your golden years?

Retirement is the r ewarding chapter of life that follows years of hard work. This new beginning, which entails freedom of time, is the chance to enjoy parts of life that could not have otherwise have experienced during the period of income-generating work – if you prepare for it properly. Thus, a conversation about finances during retirement years is of critical importance.

As a part of its continued commitment to support customers with wealth management solutions, HSBC held an educational seminar entitled “Planning a Happy Retirement,” along with its partner, New Zealand Tourism. One of the goals of the seminar was to show customers how New Zealand’s exotic beauty made the country one of the top retirement havens.

This event was held on 19 March 2014 at The Energy Building, Jakarta, and featured two speakers from the top of their fields: Christian Sidharta, Country Manager New Zealand Tourism Indonesia, and Ali Setiawan, Managing Director and Head of Global Market HSBC Indonesia.

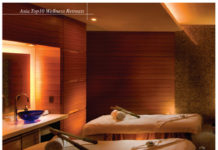

After being presented with gracious yet energetic Maori dances, customers experienced vicarious excitement of traveling across New Zealand, guided by Christian Sidharta. He engaged all of the audiences to explore the breathtaking landscapes and feel the warmth of New Zealanders’ “Kiwi” hospitality. Depth and breadth understanding about New Zealand were also given: from the country’s specific information of each region, including Auckland, Wellington, and Queenstown, to basic information such as currency (NZD) and the typical 13 hours long flight routes to get there (as there are no direct flights from Indonesia to New Zealand, people flying from Indonesia have to stop in Singapore, Australia, or Malaysia for connecting flights). Christian also mentioned the pleasure of doing relaxing activities, such as golf, wine tasting, and horse riding, which were often done by retirees in New Zealand. All of the information given during this session successfully justified New Zealand as the best place to enjoy your golden years

The discussion moved on to preparing retirement funds. Mr. George, one of HSBC’s most valuable clients, was cordially invited to share his views on how to achieve a fulfilling retirement while avoiding new burdens that might arise during your golden years. Being fully retired, he has been able to enjoy his passion for travelling because HSBC’s solutions, allowing him to maintain his high life for the long term. “Let the Bank work for me, while I just enjoy my travels,” he said.

In relation to this, Steven Suryana, as Head of Wealth Management HSBC Indonesia, pointed out the benefits of starting early in terms of saving retirement funds—one of which was being able to maintain a pre-retirement lifestyle during the decumulating period. HSBC provides comprehensive strategic financial planning that will assist their valued customers to prepare their retirement plan. It starts with a Financial Review to identify customers’ goals until comprehensive product solutions, incorporating your risk profile and preferences, can be determined. HSBC has also supported by digital capability, Wealth Dashboard, that allow our customers to easily monitor their portfolio in a holistic view and get daily market updates from Thompson Reuters and Morning Star. He also revealed that, based on a brief survey conducted that night, attendees expected to retire at an average age of 57 years old and 36% wished to continue travelling. Nevertheless, most were currently 40% to 60% away from their retirement fund’s goals.

For the many who wished to keep travelling during their golden years, the session transitioned into a discussion of Foreign Exchange. Ali Setiawan started his presentation by elaborating on IDR’s performance in the past few years and related economic events as background. According to him, investors found Indonesia attractive because of recent corrections and enhanced infrastructure. He added, however, that the Indonesian Rupiah would remain exposed to short-term risk due to several factors, namely China’s current crisis, which could greatly affect Indonesia.